Avalon Finance Director Matt Baker gave the council a presentation on the 2024-25 budget at last week’s meeting. Baker described the presentation as the first of the city’s budget workshops.

The following are highlights from the presentation, as space doesn’t allow every word to be transcribed.

“Our budget workshop order is going to change slightly from how we’ve done it in the past couple of years,” Baker said.

“Tonight I’m going to try to get through our operating revenue estimates and beginning fund balances heading into the next fiscal year, as well as provide council with the current draft of our our operating expenditures,” Baker said.

“Again, we’re sharing with you our working draft of the budget so all of the numbers in here may change between now and when we present it in June,” Baker said.

He said the council would have plenty of time to be familiar with the budget over the next few weeks.

Baker said there would be two meetings in May to go over the capital improvement program.

“Some examples of capital projects include building a new library, replacing lead water service lines with pex or another safe material, or repaving streets,” according to opengov.com.

“We have quite the CIP list planned for the next fiscal year and it was going to be hard get that all into one meeting and so I think if we can get through this tonight that’ll free up two meetings in May to really go into detail into our CIP budget for next year,” Baker said.

“Again, when we’re putting together the budget we want to make sure our revenue estimates are conservative,” Baker said.

“One of the challenges we have as a city is we are very dependent on visitor driven revenues. They can fluctuate more than say a property tax or some other revenues out there and so when we’re setting the revenue targets we need to be mindful that we’re setting it at a level we’re confident we can hit,” Baker said.

“Again, one of our goals is to be transparent in everything we’re doing so I want to make sure everyone understands how I come up with the revenue estimates because it’s really those revenue estimates that drive what funds are available then to fund our our operating costs,” Baker said.

“Then, lastly, as new revenues come in we first need to make sure we have monies to cover our normal increases to fixed costs,” Baker said.

“So every year our insurance costs go up, salaries go up, things of that nature, so when we have new monies coming in, first we need to make sure we have enough to cover those recurring costs,” Baker said.

He said the city needed to make sure there are sufficienct reserves.

According to Baker, Avalon doesn’t have a lot of varieties of debt. “But we do have some unfunded pension liabilities as well as unfunded OPB or post-employment benefit liabilities,” Baker said.

Another matter Baker raised was maintaining the city’s equipment, “whether that’s replacing vehicles or maintaining the infrastructure we have in town,” he said.

Baker said that some of the numbers in the April 16 presentation were likely to change between that night and the presentation for the actual adoption of the budget.

He said he wasn’t showing the council the budget that staff was asking the council to adopt. Baker was just showing them where staff was at this point in time.

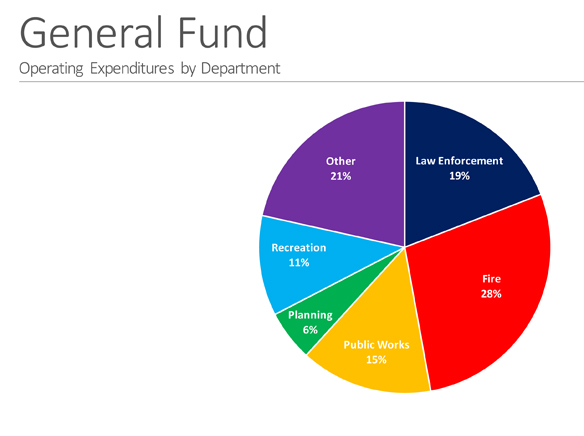

“When I’m talking operating expenditures what I mean are salaries and benefits, maintenance and operations,” Baker said.

Examples he listed were rent, utilities, office supplies, the contract with the Los Angeles Sheriff’s Department, shore boat services, and internal services—costs for departments that benefit all departments.

“For example, Finance does payroll for the Fire Department and the Harbor Department, so we have to charge those departments for our services,” Baker said.

According to Baker, hotels and vacation rentals are about three fourths of the city’s operating revenues.

“Those are all very much visitor driven or visitor dependent,” Baker said.

According to baker, hotels and vacation rentals are about three fourths of the city’s operating revenues. “Those are all very much visitor driven or visitor dependent,” Baker said.

Baker said property tax, licenses, permits, and charges for services make up only about a quarter of Avalon’s operating budget.

Baker said that in fiscal year ’22 the city had an increase in visitor-driven revenues.

“If you take away the one-time ARPA monies we received in fiscal year ’22, you really see we really have pleateaued,” Baker said.

“While plateau is not necessarily where we want to be, it certainly is a stronger position that we were in fiscal years ’19, ’20 and ’21,” Baker said.

He said visitor-driven revenues have been where the growth was taking place.

According to Baker, revenues that were not visitor-driven have been flat. He said visitor-driven revenues have been where the growth has been.

Baker said if you looked at the city’s TOT revenue for the first eight months of the fiscal year, the trend was down about 5%.

His estimates for the current fiscal year put TOT revenue between $7.7 million (low end) and $8.2 million (high end).

Baker went over his revenue estimates. Sales tax, which he described as one of the few positive numbers on the slide, is estimated to increase by 5.9%.

Property tax was estimated to decrease 11.9%.

He said staff was working on a budget with operating revenues of about $12.8 million.

Baker reminded the council that those numbers could change, depending on information in March or April.

According to Baker, assuming Avalon spends all the capital improvement budget, the city would end up with around $13.5 million.

Baker expected that number would actually be higher because there were a lot of capital projects that the city would not get to before June.

Baker said going into Covid, Avalon had $4.5 million in reserves and now Avalon has $14 million.

“Every year our costs do go up, but we’re doing our best to manage that grwoth while still restoring services that were previously cut,” Baker said.

He showed the council a slide of expenditures by department. The Fire Department, for example, was expected to have a budget of $3.5 million.

He said the Harbor Department Fund follows a similar pattern to the General Fund.

“We had no cruise ship revenue in ’21,” Baker said.

Baker said he thought cruise ship revenue this year would come in around $1.75 million.

In the working budget for the 24-25 budget, Baker said he was currently using the number $9.1 million.

Turning to cruise ships, Baker said Avalon was seeing an increase in the passenger capacity of cruise ships. That, in turn, is increasin wharfage, according to Baker.

“The two Carnival ships we had prior to Covid topped out around 2,500 passengers and the Carnival ships that have since replaced them, not even consideirng the new one that is coming, carry about 3,500 passengers,” Baker said.

Baker also said Avalon has more cruise operators coming more days. Baker anticipated an increase in paying for the cost of Other Pension Benefits for retirees, but said that could be discussed so they would not be paid in one year.